Elevance Health, Inc.ELV is scheduled to report second-quarter 2024 results on Jul 17, before the opening bell.

The Zacks Consensus Estimate for second-quarter earnings per share of $10 indicates a 10.6% increase from the prior-year figure of $9.04. The estimate increased by a penny in the past week. However, the consensus estimate for second-quarter revenues of $43 billion indicates a 0.9% decline from the year-ago reported figure.

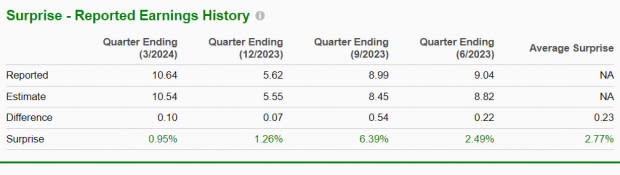

Elevance Health beat the consensus estimate for earnings in all the prior four quarters, with the average being 2.8%.

Image Source: Zacks Investment Research

Earnings Whispers

Our proven model predicts a likely earnings beat for Elevance Health this time around as well. The combination of a positiveEarnings ESPand a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold) increases the chances of an earnings beat, which is precisely the case here.

ADVERTIsem*nT

Earnings ESP:Elevance Health has an Earnings ESP of +0.40%. This is because the Most Accurate Estimate is currently pegged at $10.04 per share, higher than the Zacks Consensus Estimate of $10. You can uncover the best stocks to buy or sell before they’re reported with ourEarnings ESP Filter.

Zacks Rank:Elevance Health currently has a Zacks Rank #2.

Factors Likely to Shape Q2 Results

Elevance Health’s second-quarter revenues are likely to have benefited from improved product revenues and solid contributions from its Carelon and Health Benefits units. The rising memberships attributable to ELV’s Commercial Individual, Commercial Fee-based, Vision and Dental businesses are expected to have provided an impetus to the second quarter’s performance.

The Zacks Consensus Estimate for product revenues indicates 5.1% growth from the year-ago period’s $4.9 billion, whereas our model suggests more than 6% increase. The consensus mark for Commercial Individual membership suggests 31.9% growth from a year ago. Similarly, the consensus estimate for Commercial Fee-based memberships indicates a 2.1% year-over-year jump, while our estimate hints at a 2% increase.

The company’s Health Benefits business is likely to have been driven by rate adjustments and commercial fee-based membership growth. The Zacks Consensus Estimate for the segment’s operating income for the second quarter predicts a 4.6% year-over-year increase, whereas our model envisions a 3.8% growth. Improving premium yields coupled with conservative and disciplined underwriting practices is expected to continue enhancing the margins.

Meanwhile, the Zacks Consensus Estimate for Carelon brand’s operating income for the second quarter indicates a 14% year-over-year increase, whereas our model predicts 10.3% growth. Growth in both Carelon Services and CarelonRx is expected to have aided the brand. Diversifying revenue streams by serving other payers’ customers is likely to have helped this segment in the second quarter. External revenue growth might have offset any softness in customer volume growth in the second quarter. These are likely to have positioned the company’s bottom line for not only a year-over-year increase but also an earnings beat.

The company’s expenses are likely to have declined due to lower benefit expenses, cost of products sold, and interest expenses. Our estimate for total expenses implies a decrease of 1.7% year over year in the second quarter of 2024.

Declining memberships in total Medicare, Medicaid, and Employer Group Risk-based are likely to have affected second-quarter premiums. The Zacks Consensus Estimate for premiums indicates a 2.2% year-over-year decline, while our estimate suggests a 2.6% fall.

Conclusion

Improved product revenues, underwriting discipline, a strong Carelon segment, and declining expenses are likely to have offset the negative impact of declining memberships in Medicare and Medicaid, resulting in earnings beat for the second quarter.

Other Stocks That Warrant a Look

Here are some other companies worth considering from the broaderMedicalspace, as our model shows that these, too, have the right combination of elements to beat on earnings this time around:

The Cigna GroupCI has an Earnings ESP of +0.94% and is a Zacks #2 Ranked player. You can seethe complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Cigna’s second-quarter earnings indicates a 4.7% year-over-year jump. CI beat earnings estimates in each of the past four quarters, the average surprise being 3.3%.

Cencora, Inc.COR has an Earnings ESP of +1.01% and a Zacks Rank #3.

The Zacks Consensus Estimate for Cencora’s second-quarter earnings indicates 8.9% year-over-year growth. COR beat earnings estimates in each of the past four quarters, with an average surprise of 6.1%.

Edwards Lifesciences CorporationEW has an Earnings ESP of +0.58% and is a Zacks #3 Ranked player.

The Zacks Consensus Estimate for Edwards Lifesciences Corporation’s second-quarter earnings indicates a 6.1% year-over-year jump. EW beat earnings estimates in each of the past two quarters and met on the other two occasions, the average surprise being 1.2%.

Stay on top of upcoming earnings announcements with theZacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Edwards Lifesciences Corporation (EW) : Free Stock Analysis Report

Cigna Group (CI) : Free Stock Analysis Report

Cencora, Inc. (COR) : Free Stock Analysis Report

Elevance Health, Inc. (ELV) : Free Stock Analysis Report